Industry Dynamics

Business guide to Industrial IoT (Industrial Internet of Things)

Counts:456 Time: 22-02-16 From: Suzhou Teknect Engineering Co., Ltd.Industrial IoT, short for the Industrial Internet of Things, originally described the Internet of Things (IoT) as it is used across several industries, such as manufacturing (Industry 4.0), logistics, oil and gas, transportation, energy/utilities, mining and metals, aviation and other industrial sectors and the use cases which are typical to these industries.

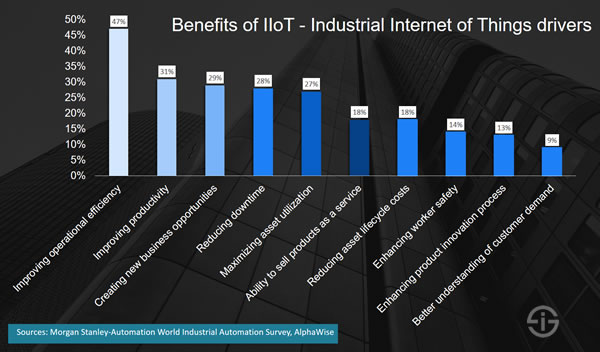

Just like the Internet of Things in general, the Industrial IoT covers many use cases, industries and applications. Initially focusing on the optimization of operational efficiency and rationalization/automation/maintenance, with an important role for the convergence of IT and OT, the Industrial Internet of Things opens plenty of opportunities in automation, optimization, intelligent manufacturing and smart industry, asset performance management, maintenance, industrial control, moving towards an on demand service model, new ways of servicing customers and the creation of new revenue models, the more mature goal of industrial digital transformation.

At the center of it all: as per usual in this data age, connected and aggregated data from assets and machines and how all that big data is turned into knowledge, intelligence, action, value and thus Industrial IoT use cases (remember the DIKW model).

The definition(s) of Industrial IoT

Although most Industrial IoT projects are about automation, optimization and tactical or strategic goals in a mainly internal context – and will continue to be, we’ve seen some really transformational Industrial IoT (also known as IIoT) projects as well. More about the initial goals of many IIoT projects below. For now, back to what the Industrial IoT is.

Industrial IoT as the leverage and reality of IoT in a context of industrial transformation

Industrial IoT in the earlier mentioned sense was mainly used to make a distinction between the use cases, actual usage and specific technologies as leveraged for initially mainly smart manufacturing (smart factory) and, later, other industries on one hand and enterprise IoT and consumer IoT applications on the other.

This distinction obviously is somewhat artificial and on all levels there are overlaps. The fastest growing categories of IoT use cases, for instance, are cross-industry. Moreover, although some technologies, architectural frameworks and applications across all IoT layers differ (edge computing and fog computing are typical in Industrial IoT, there are different types of network and connectivity tools, IIoT gateways serve other purposes, Industrial IoT platforms support other use cases than IoT platforms overall, digital twins are mainly about industrial markets, the use cases for augmented reality are not the same and so forth) between Industrial IoT and Consumer IoT an average large IIoT project will leverage several forms of connectivity and solutions of which some are used in consumer IoT as well.

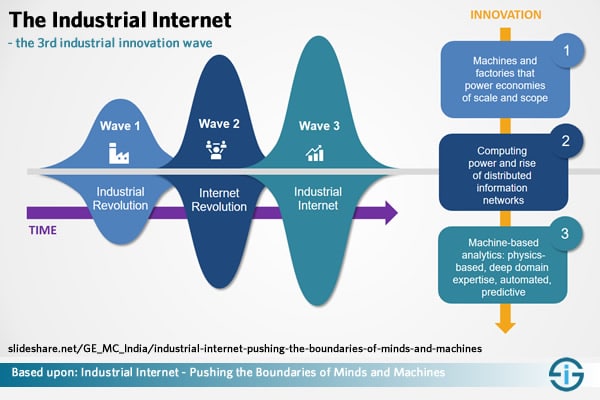

GE and Industrial IoT as a synonym of Industrial Internet

The Industrial Internet of Things also has a second meaning to complicate things. Industrial giant GE coined the term Industrial Internet which really describes industrial transformation in the connected context of machines, cyber-physical systems, advanced analytics, AI, people, cloud, IoT edge computing and so forth.

Although you won’t find the term cyber-physical systems (essentially Industrial IoT in the first sense in action and in a context of autonomous and semi-autonomous decisions and actionable intelligence) we added it because Industrial Internet in many ways is the same as Industry 4.0 (more about that and the links between IIoT and Industrial Internet at the bottom of this article).

What does this have to do with Industrial IoT? Well, GE and the Industrial Internet Consortium or IIC it (co-)founded decided that the Industrial Internet of Things or IIoT was a synonym for the Industrial Internet.

One can wonder why you need two terms to describe the same thing. When vendors are involved one can then think marketing and compare how often the term Industrial Internet is searched for and how often terms such as Industrial Internet of Things, IIoT and Industrial IoT are searched for. That doesn’t mean that Industrial IoT in the sense of Industrial Internet doesn’t make sense, well on the contrary of course. Yet, it does lead to confusion, depending on where you live. More about these terminology and definitions below in this article in case you are interested.

What matters most to us isn’t the jargon but the results although it would be nice if everyone spoke the same language and didn’t toss up new terms the whole time. In that regard you can also compare with the Internet of Everything, a term Cisco coined and used up until 2016. In many regards the Internet of Everything in an industrial context is closer to Industrial IoT, the GE way, than to Industrial IoT in the first sense.

The Industrial Internet of Things in evolution: from operational efficiency to innovation

The core focus in most Industrial Internet of Things deployments and in the majority of organizations de facto is still on operational efficiency, along with cost optimization. Or as IDC called it: efficiency optimization and linking islands of automation as key drivers. However, a more holistic approach with additional revenue and innovation goals is needed.

Such a holistic strategy already exists in more ‘mature’ industrial organizations, which have shifted to the business model, service and new revenue opportunity side with tangible results and innovative solutions. They are poised to be disrupters in their respective industries where competition is already intensive and market conditions uncertain and complex.

The power of the Internet of Things comes from the ability to collect a lot of data and convert that into useful information (Bertil Thorvaldson, ABB Robotics)

On the other hand, in order to move up in the IIoT maturity and possibility/opportunity reality, industrial organizations obviously need to start somewhere. Knowing the market challenges and the lowest hanging fruit in many industrial markets it’s normal that in initial stages connectivity in the IIoT space is focusing on a restricted set of goals and benefits. Yet, it’s important to have a roadmap or plan for the longer term. It is not a coiincidence that the holistic challenge we see in the evolution of IIoT is exactly the same as the one we see in the digital transformation of manufacturing, the main IIoT market.

Last, but not least, optimization and automation are not the enemy of customer-centricity in the larger industrial context where speed and enhanced processes are what customers expect.

Industrial IoT across major industries

The Industrial Internet of Things can be defined as ‘machines, computers and people enabling intelligent industrial operations using advanced data analytics for transformational business outcomes” (see infographic at the bottom).

In this Industry 4.0 or ‘Industrial Internet’ context, where we essentally find the IIoT as part of an integrated approach where it takes center stage, data is a key asset and analytics a necessity in the connected sphere of products (across their full life cycle), production assets and more.

The Industrial Internet of Things is the biggest and most important part of the Internet of Things now but consumer applications will catch up from a spending perspective, mainly starting 2018. Still, the Industrial Internet of Things is far more important and advanced in the overall IoT picture.

Manufacturing: the largest Industrial Internet of Things market

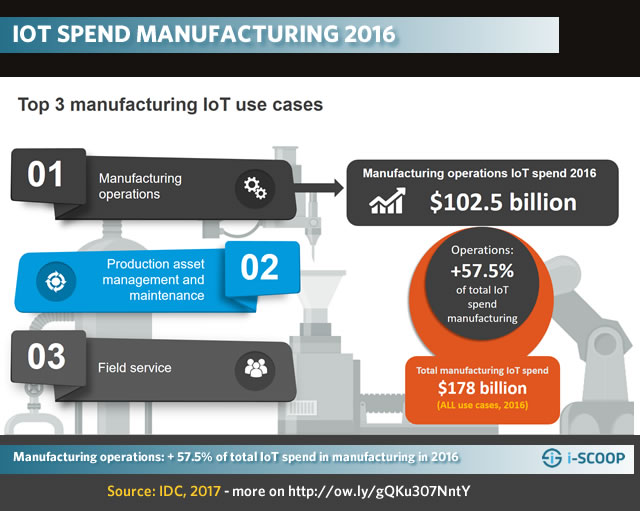

The first one is manufacturing. It is also the largest industry from an IoT spending (software, hardware, connectivity and services) perspective.

In 2016, manufacturing operations alone accounted for an IoT spend of $102.5 billion on a total of $178 billion, all IoT use cases in manufacturing combined. With a total spend of $178, manufacturing overall is by far the largest industry in the Internet of Things AND of the Industrial IoT and the segment of manufactoring operations outweighs all other IoT use case investments across all industries, consumer included.

Two other IoT use cases which are important in manufacturing from a spending perspective, on top of operations, are production asset management and maintenance and field service, according to the mentioned research by IDC, released early 2017.

A more detailed overview of the evolutions in the manufacturing IIoT market, including more data, benefits and IIoT cases on our Internet of Things manufacturing page.

Industrial IoT in connected logistics and transportation

Transportation represent the second largest market from an Internet of Things spending perspective. Transportation and logistics (T&L) firms are looking to move up the value chain with advanced communication and monitoring systems, enabled by IoT.

The global connected logistics market is poised to grow at a CAGR of approximately 30% until 2020.

The transportation market reached an IoT spend of $78 billion and is poised to continue to grow rapidly, just as is the case for the IoT manufacturing market. The main use case in transportation is freight monitoring, good for a large majority of overall transportation IoT spend with a total of $55.9 billion and remaining a key driver in the market until 2020.

If we look at the overall IIoT evolutions in transportation and logistics, we see the growing emergence of a digital supply chain and connected logistics reality, which is at the same time one of the challenges for the manufacturing industry and the T&L market as such as many players don’t have a digital strategy in place and are urged to speed up their digital transformation efforts. As you can read here, about 20 percent of digital transformation costs in T&L will be allocated to supply chain transformation. It’s clear that the Internet of Things plays an important role here.

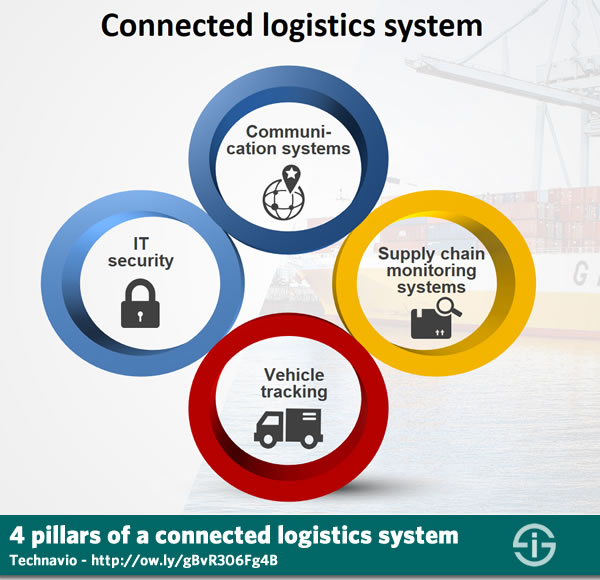

This is also the case for the four pillars of a connected logistics system as Technavio defined them: IT security, communication systems, supply chain monitoring systems and vehicle/transport tracking. Along with the cloud and analytics, the Industrial Internet of Things is a driver in the connected logistics landscape and freight monitoring leads the pack.

Smart supply chain management (Logistics 4.0) is also a data-intensive and IoT-intensive given with a focus on (semi-)autonomous decisions.

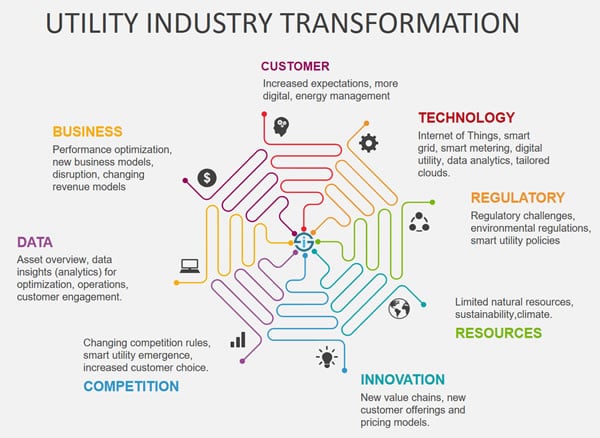

Industrial IoT in energy and utilities

Oil and gas, smart grid and plenty of other evolutions and use cases in the energy and utilities market overall are also a main part of the Industrial Internet of Things market.

According to the earlier mentioned data from IDC, utilities alone is the third industry from the IoT spending context, having reached a total of $69 billion in 2016. Here as well there is one area of investment that clearly sticks out: smart grid for electricity and gas, which accounted for a whopping $57.8 billion in 2016.

The Industrial Internet of Things plays a key role in the overall digital transformation towards a digital supply chain in many parts and value chain components of the large ecosystem, which obviously also touches retail/consumer-facing aspects.

However, from the sheer Industrial Internet perspective, smart grids are key in supply and network transmission/distribution. Others include plant effectiveness, maintenance and data-driven opportunities as a result of smart grids and IoT-enabled operations and services.

The Industrial Internet of Things in other industries

Maintenance and services, enabled by the IIoT are two key areas in virtually all Industrial Internet industries.

Predictive maintenance, data-enabled services and remote possibilities in several areas, from service to control and optimization of operations, also come back in many other IIoT use cases across industries such as healthcare (remote health monitoring, equipment maintenance, etc.), aviation, robotics and cobots, oil and gas, mining, metals and more.

As mentioned, depending on the industry body, the broader context of IIoT is also often used for use cases in areas such as agriculture, smart cities and so on.

The Industrial Internet of Things in context

We saw how the initial purpose of IIoT projects typically is to automate, save costs and optimize in often rather siloed and ad hoc ways and how it’s important to have a more holistic view and strategy, whereby there is a shift towards goals of inovation, better customer-centric service offerings, leveraging new sources of data-driven revenues, building ecosystems of value and ecosystem-wide digital transformation goals.

As mentioned, the Industrial Internet of Things enables industries to rethink business models. Generating actionable information and knowledge from IIoT devices, for instance, enables the creation of a data sharing ecosystem with new revenue streams and partnerships.

The other way around, aggregated and real-time data from sensors and from information sources which can be ‘consulted’ via built-in capabilities also lead to the development of robots which can take specific actions because of these built-in capabilities whereby IIoT becomes a driver of ‘decision-making’ devices. This already happens in some warehouses and is called the Internet of Robotic Things (IoRT). It is used in an IIoT context but also a consumer IoT context.

The usage of the Industrial Internet of Things, within a broader context, ultimately leads from specific projects and ‘smart’ IIoT use cases to connected ecosystems.

Supply chains become connected supply chains, factories become connected factories and so forth. In this sense, the connectedness stretches far beyond the simple connectedness – and data-driven results – of devices and industrial assets to a more connected ecosystem, whereby the extended enterprise gains a new meaning.

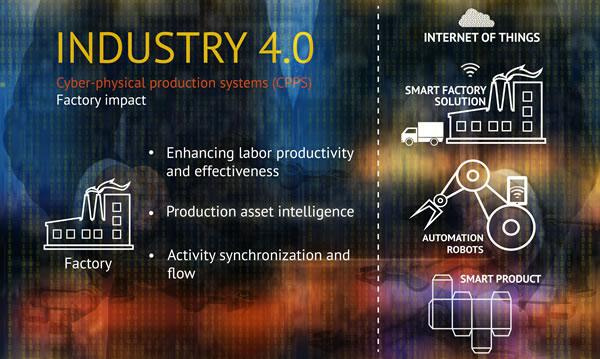

This is why the Industrial Internet of Things is mainly used in the context of Industry 4.0, the Industrial Internet and related initiatives across the globe, which all have their own names, from smart production to smart factory or intelligent industry as we tackled in the introduction (definition section). Industry 4.0 (which we tackle more in depth in an IIoT context below) describes a new industrial revolution with a focus on automation, innovation, data, cyber-physical systems, processes and people. On top of IIoT, Industry 4.0 also is about other technologies; which are related with it.

Examples include robotics, cloud computing and the evolutions in operational technology (OT). In the Industrial Internet of Things, IT and OT need and meet each other. Industry 4.0 further refers to cyber-physical production systems (CPPS) and typical embeds the so-called third platform technologies and accelerators of what is known as the digital transformation or DX economy.

Industrial Internet of Things use cases

Despite the link with factories, manufacturing and heavy industries like mining, , aviation, oil and gas, defense, power and electricity and energy overall, as mentioned the IIoT is often also used to describe several Internet of Things applications outside of the Consumer Internet of Things.

So, de facto it is also used for industries such as agriculture, connected logistics, finance, the government sector (including smart cities), healthcare (hospitals and healthcare facilities) and cross-industry IoT use cases such as smart buildings in a context of facility management. Depending on the view and industries that are understood in an Industrial Internet of Things context, this leads to less or more IIoT use cases.

Below are a few typical IIoT use cases and business contexts – if we broaden IIoT beyond only manufacturing and the likes

- Smart factory applications and smart warehousing.

- Predictive and remote maintenance.

- Freight, goods and transportation monitoring.

- Connected logistics.

- Smart metering and smart grid.

- Smart environment solutions.

- Smart city applications.

- Smart farming and livestock monitoring.

- Industrial security systems

- Energy consumption optimization

- Industrial heating, ventilation, and air conditioning

- Manufacturing equipment monitoring.

- Asset tracking and smart logistics.

- Ozone, gas and temperature monitoring in industrial environments.

- Safety and health (conditions) monitoring of workers.

- Asset performance management

- Remote service, field service, remote maintenance and control use cases.

The Industrial Internet of Things market: size, growth and impact on economy

The market opportunity of the IIoT is huge. According to IndustryARC research (June 2016), the industrial IoT market is estimated to reach $123.89 Billion by 2021 at a high CAGR.

In the graphic below you can also see some forecasts by Morgan Stanley, data on the impact of IIoT on the global economy by Accenture and another forecast from Research and Markets. Leaders in the IIoT space, such as GE, also have impressive forecasts but, again, it all depends on what you exactly measure and how you define IIoT.

ENGLISH

ENGLISH  简体中文

简体中文